Aviation watchdog JonNYC shares fascinating internal slides from United Airlines outlining how their premium business is doing. They are excited about how their seat fees, premium economy, and business class are doing – especially notable is performance to what’s generally seen as the most premium market, London Heathrow – and how demand has shifted from traditional business travelers to premium leisure.

UA stuff

— JonNYC (@xjonnyc.bsky.social) March 17, 2025 at 6:14 PM

— JonNYC (@xjonnyc.bsky.social) March 17, 2025 at 6:14 PM

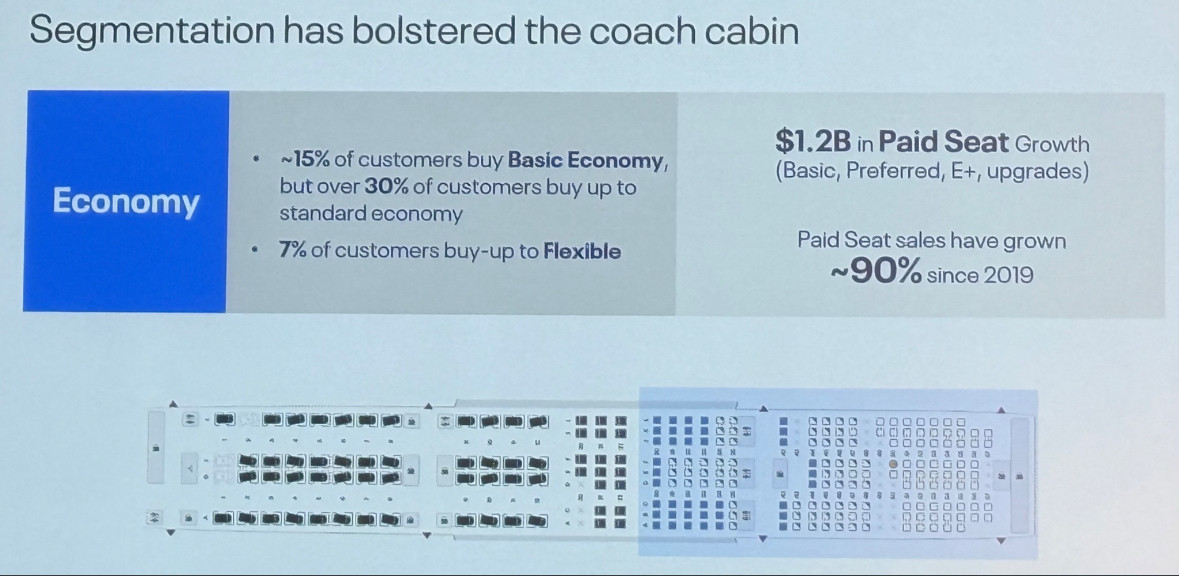

Basic Economy Gets Customers To Pay More

Airlines used to use Saturday night stays and 14-day (or 21-day) advance purchase requirements to get the cheapest tickets. That’s how they differentiated business and leisure travelers, offering the cheapest fares to price-sensitive customers while charging orders of magnitude more to those who would pay. However that model began breaking down about 20 years ago, with low cost carriers not imposing those same restrictions.

That meant airlines started charging lower fares to avoid losing ticket sales, and in the process charging passengers less than they were willing to pay. Their solution is basic economy – they impose draconian restrictions on the cheapest tickets, so that price sensitive customers buy those while those willing to pay more (and those traveling on someone else’s dime) pay up to avoid the restriction.

United’s are the worst – a basic economy passenger isn’t permitted to bring a regular carry-on bag onto the aircraft, which of course also means they’re charged more in checked bag fees too. Until recently, a United basic economy passenger who wasn’t checking a bag was still forced to check in in person (and wait in line, paying in time rather than money) and couldn’t use online or mobile app check-in.

Since United flies larger planes with more seats, which keeps their cost per seat low, they have extra seats to sell that don’t go out at a premium. That’s where their basic economy inventory comes in, which they say represents 15% of ticket sales.

At the same time, a larger percentage buy up out of these restrictions because they’re miserable. And customers increasingly pay for seat assignments, too – a customer preference and a sign that United has gotten better at merchandising. Between upgrades and economy seat fees, United reports “$1.2 billion in paid seat growth” which is up 90% versus pre-pandemic.

And, I’d note, that on domestic flights, selling seat assignments and upgrades separately from the fare is saving the airline from paying 7.5% tax on the revenue (just as it does with checked bag fees on domestic flights). United, like the other large carriers, is engaging in a nine-figure tax dodge.

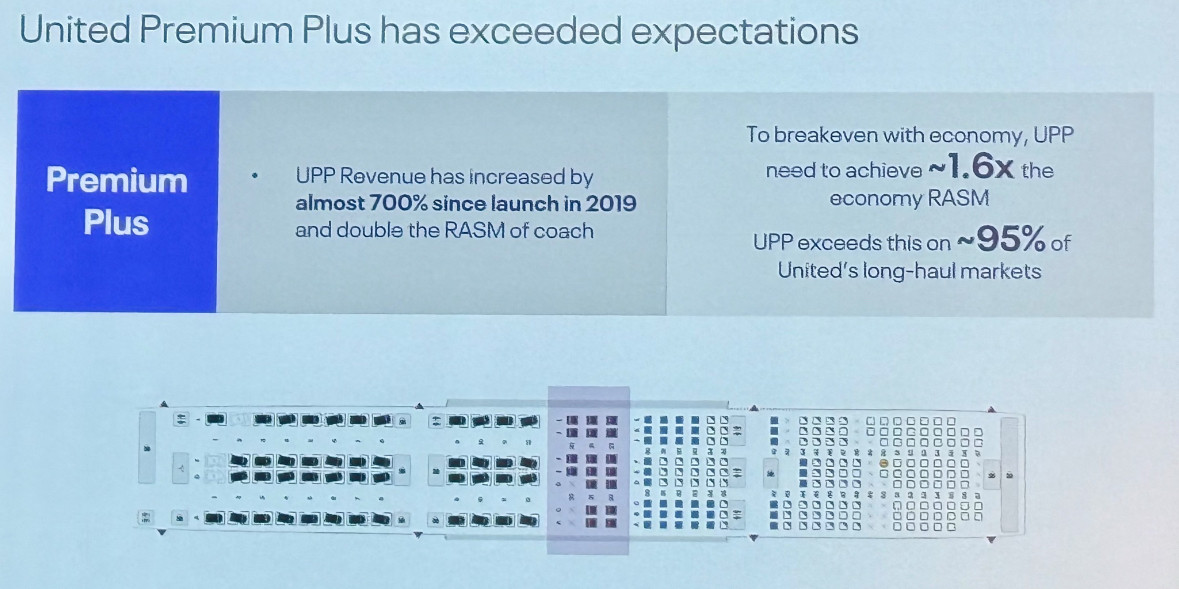

Premium Economy Is Highly Profitable

Ignore that United’s premium economy revenue has increased ‘almost 700%’ since launch. That’s off of a base of basically zero. Instead, what matters is United’s non-bolded claim that it generates double the revenue per seat mile of coach – while break even (given the larger seat footprint, and slightly greater soft product investment) is 1.6x.

United says the cabin is more profitable than coach in about 95% of long haul markets. On long haul flights people will pay a modest multiple (of at least 1.6x economy) to get out of economy, and I’d note in particular to get out of United economy with its limited space and hard seat. Many foreign carriers offer more comfortable coach products with up to 34 inches of pitch, more padded seats, and things like foot bars and cup holders at the seat and friendlier service.

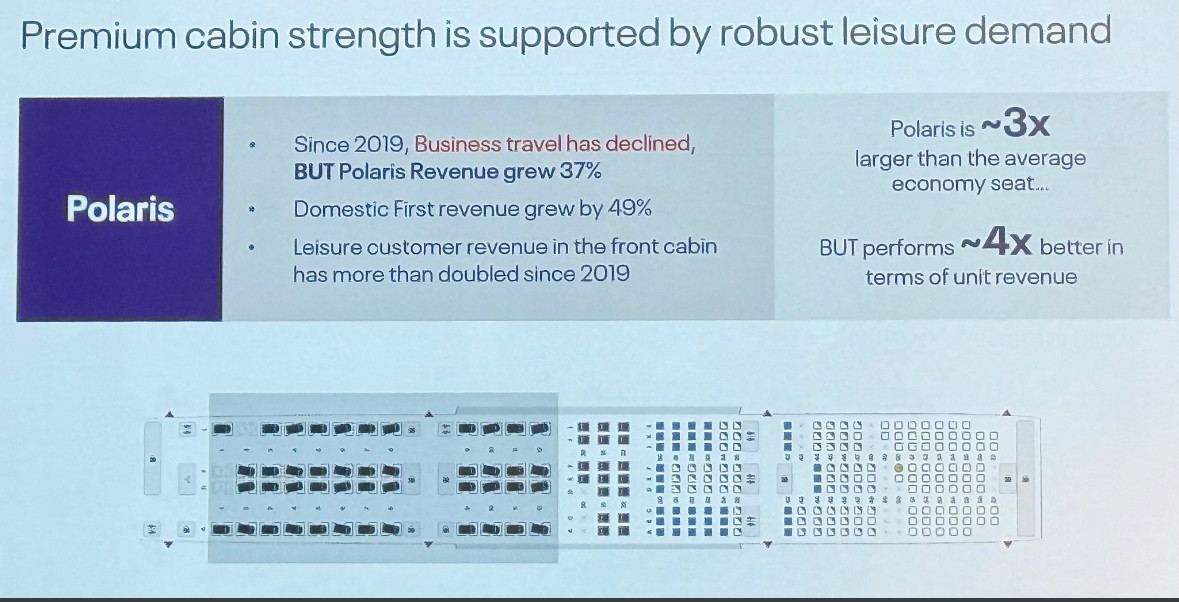

Premium Leisure Replaced Business Travel As Revenue Driver

United acknowledges that business travel is down versus pre-pandemic. Travel executives usually wave their hands a bit at this. The traditional consultant out Monday back Thursday, spending the week at client offices, is largely dead. That’s because there’s no reason to sit in a client’s office where the client’s own return to work means that not everyone is in their office every day. And the vagaries of in-office means that visiting people in offices is less frequent, too, and more challenging to coordinate.

Nonetheless, premium leisure has taken off and United reports that their business clsas revenue is up 37% (no one ever notes the effect of inflation here, which accounts for over half of this). Domestic first class revenue has spiked 49% in nominal terms, noting that premium leisure in first and business has “more than doubled since 2019” picking up the slack from managed business.

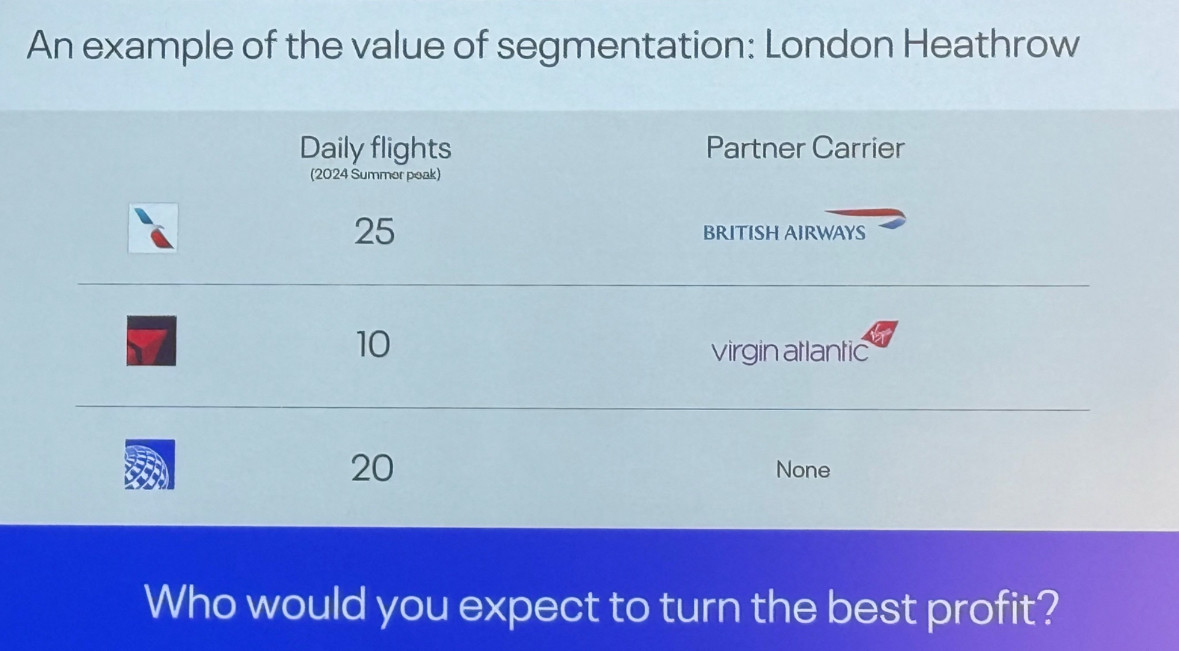

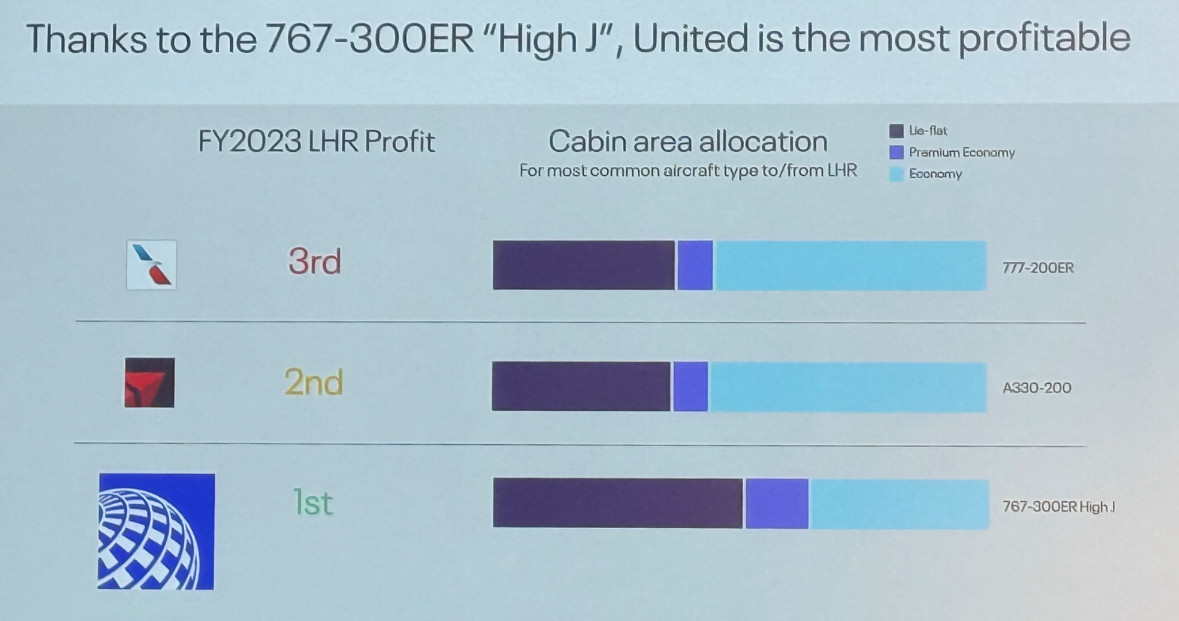

United Says It’s Winning London Heathrow Thanks To Premium

United says that they are more profitable than both Delta and American at London Heathrow, despite not having a joint venture partner there the way both carriers do. They say this is because they’re flying proportionately more premium seats, and Heathrow is still a premium-heavy market.

Back in 2018 Vasu Raja complained that he didn’t have enough premium seats on planes, as the airline was removing premium seats from its widebody aircraft. US Airways management didn’t have a vision to be a premium carrier, and in their experience long haul business class could only be sold at a discount which turns out to be wrong.

The wrong aircraft configuration is something American is trying to fix on narrowbodies (adding first class seats, albeit not addressing too few extra legroom coach seats) and on their new delivery Boeing 787-9s. But so far there are no plans announced to retrofit their workhorse widebodies crossing the Atlantic.

Meanwhile, I’d argue that United’s point about outperforming despite lack of a joint venture partner is a bit underdeveloped. Delta partners with (and owns 49% of) Virgin Atlantic, which gives them to schedule aircraft more efficiently across routes which means it’s a bit misleading to look at performance only of Delta’s own metal. Moreover, the joint venture with Virgin doesn’t give Delta much in the way of connecting traffic or options for travelers given Virgin’s limited slot portfolio (that doesn’t allow scheduling for connections). Of course, connecting traffic over Heathrow is likely in most cases to be lower yield than non-stop.

United Is A Premium-Heavy Airline, Rather Than A Premium Airline

While United and Delta are lumped together as the two ‘premium airlines’ in the United States, that is a bit of a misnomer. Most passengers fly coach, and the extent of United’s premium focus in the back cabin is seat back screens and snacks a food for sale, but those are really differentiators in the domestic market rather than international.

For long haul, United offers a lot of premium seats and a consistent product. Their long haul business class bedding is very good. But the seat is not spacious – in fact the opposite. The Polaris seat was signed off on a decade ago precisely because it was a way to get lie flat direct aisle access into planes in the densest format possible. The seat stopped the bleeding, as their extant 2-2-2 seating meant customers booked away from the carrier. American’s seats are better, and Delta’s seats outside of the Boeing 767 are better.

Polaris lounges are better than American Flagship lounges, but lag the (couple of) Delta One lounges. United’s meals don’t differentiate, though they’ve recently leaped forward with their business class wine program.

Unquestionably, Air France and KLM offer better products across the Atlantic. British Airways probably does as well, leaning into its better seat. But there’s no question that United has performed better financially, and improved its product, versus the cost-cutting Smisek era.